- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

Professional Analysis: Automotive Body Trim StripsAutomotive partsComplete Process of Overseas Procurement andImport RepresentationPractical Guide

Author: (20 yearsforeign tradeservice expert with 20 years of industry experience, this article will systematically analyze the core points of clothingExport Representationof service experience)

Introduction

Against the backdrop of the booming global automotive aftermarket, automotive body trim strips, as important accessories for enhancing vehicle appearance quality and meeting consumers personalized needs, have seen continuous growth in import volume in recent years. According to data from the China Association of Automobile Manufacturers, Chinas automotive modification market size exceeded 160 billion yuan in 2022, with body decoration products accounting for 35%. However, due to the complexity of overseas procurement involving cross-border supply chain management, technical standard alignment, tax compliance, and other issues, many enterprises face surging procurement costs, delivery delays, and even legal risks due to a lack of professional experience. Based on 20 years of industry service experience, this article provides an in-depth analysis of the core points of import agency for automotive body trim strips.

Current Status and Industry Pain Points of Overseas Procurement of Automotive Body Trim Strips

Internationally - recognized Safety StandardsCharacteristics of Global Supply Chain Distribution

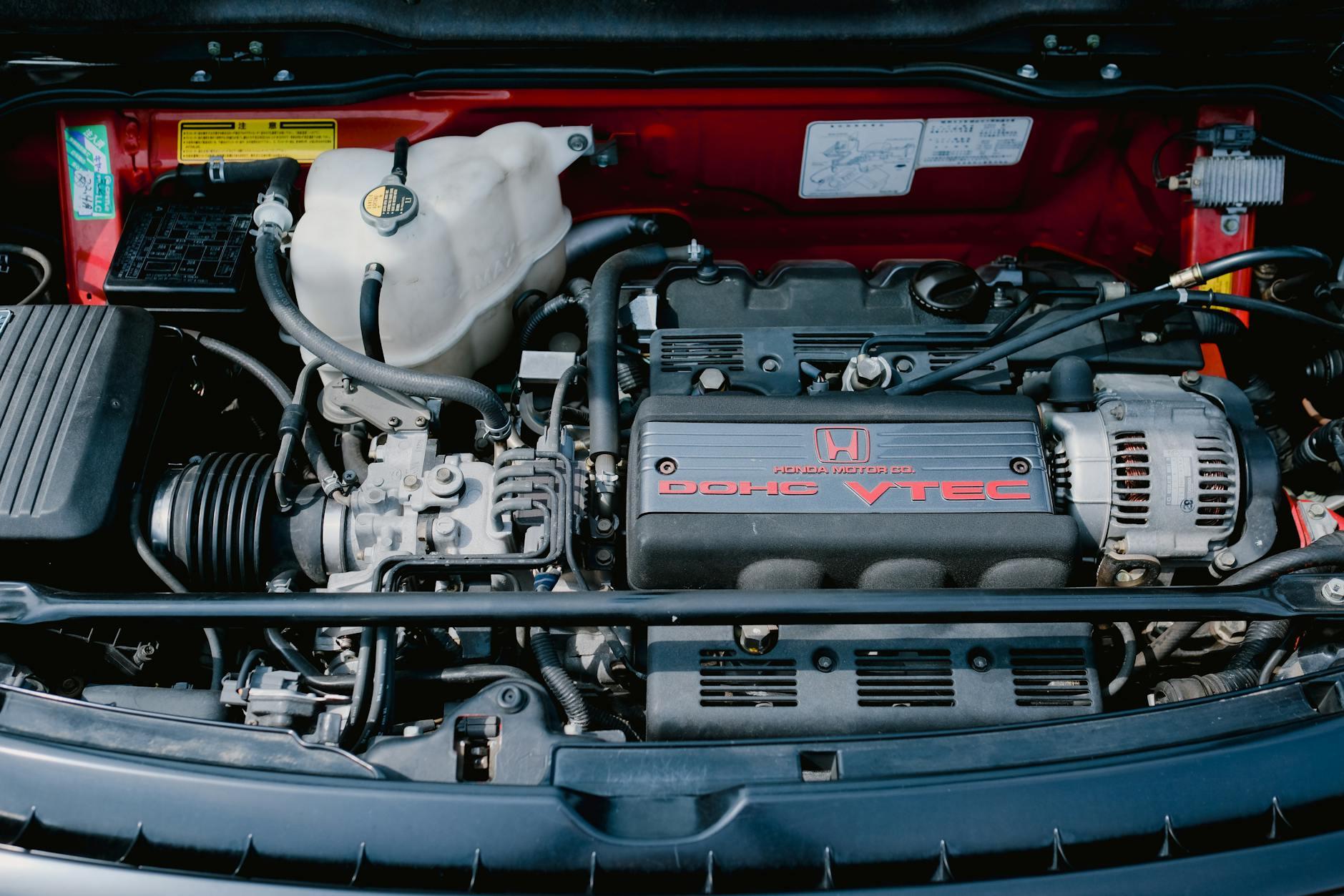

- High-end market: Germany (BOSCH, HELLA), Japan (YAKIMA), and the United States (3M) dominate the OEM market

- Cost-effective market: Southeast Asia (Thailand, Vietnam) and Eastern Europe (Turkey) have become OEM manufacturing bases

- Emerging trends: Innovative products such as carbon fiber materials, LED light guide strips, and aerodynamic kits are seeing a 25% annual growth in demand

Regional Mandatory CertificationsCommon Procurement Pain Points for Enterprises

- Supplier identification dilemma: Difficulty in verifying overseas factory qualifications, with trading companies posing as manufacturers

- Technical Barriers: Regulatory differences such as EU e-mark certification, U.S. DOT standards, and Chinas GB/T 24550 collision test

- Logistics losses: Transportation damage rates for electroplated parts/acrylic materials are as high as 18% (industry average)

- Hidden Costs: Sudden risks such as VAT deferral and anti-dumping duties (e.g., the EUs 30.6% tariff on Chinese aluminum products)

Value Creation System of Professional Import Agency Services

Pre-procurement: Strategic Supplier Development

- Implement the Three-Dimensional Screening Method:

- Compliance Dimension: Verify ISO/TS 16949 certification and factory environmental assessment reports

- Capacity dimension: Confirm the number of molds through video factory inspections (at least 5 single-color injection molding machines required)

- From the perspective of risk controlRetrieve corporate credit report (recommended using D&B or Coface database)

Case studyIn 2021, acting as procurement agent for anNew energyautomaker purchasing illuminated door sills, discovered through surprise factory audit by German TüV that a Polish suppliers actual capacity was only 40% of claimed, promptly switched to Turkish supplier avoiding $2 million loss.

Order execution: End-to-end precision management

- Technical docking:

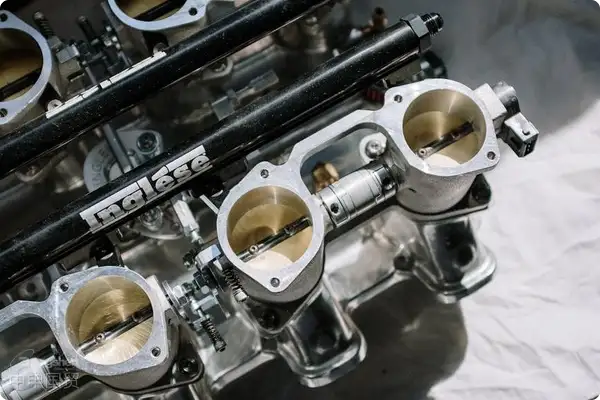

- Material testing: On-site verification of aluminum alloy composition using XRF spectrometer (significant difference between AA6063-T5 and AA6061)

- Color difference control: Commissioned third-party testing for color fastness with ΔE≤1.5

- Logistics solution:

- Precision packaging: EPE foam + ABS blister tray combination for shock absorption, reducing costs by 30%

- Special transportation: For oversized parts (>2.4m), used open-top container + air cushion vehicle intermodal transport

Customs clearance and tax optimization strategies

- Rational policy utilization:

- Classification recommendation: Classify LED decorative strips under HS 8708.29 (8% tariff) instead of 9405.40 (12% tariff)

- FTA benefits: Reduced TPU material import tariff from South Korea from 10% to 0 under China-Korea FTA

III. Golden rules of risk management and cost control

Internationally - recognized Safety StandardsQuality dispute resolution mechanisms

- Pre-signing Defect Handling Agreement: Stipulating full compensation clause when batch defect rate exceeds 3%

- Quality bond system: Retaining 10% final payment as 24-month warranty deposit

Regional Mandatory CertificationsCost control toolkit

- Exchange rate locking: Using forward settlement to hedge USD/EUR fluctuations (saved ¥830,000 in forex loss for 2023 project)

- LCL optimization: 40% reduction using AI loading systemMaritime TransportationCost (applicable for small trial orders)

IV. Industry trends and forward-looking deployment suggestions

Internationally - recognized Safety StandardsTechnology iteration directions

- Eco-materials: Bio-based PP (e.g., BASF Ultramid?) replacing traditional ABS

- Smart integration: Stealth trim with millimeter-wave radar (already applied in Tesla Cybertruck)

Regional Mandatory CertificationsSupply chain restructuring opportunities

- Nearshoring: Mexican factories reduce lead time by 15 days compared to Asia (preferred by American brands)

- Digital procurement: Blockchain enables full-chain traceability from aluminum ingot to finished product delivery

Conclusion

Automotive trim import business has evolved from simple goods trading to systematic engineering covering technical standards, smart logistics, and compliance risk control. Choosing import agents with deep automotive industry expertise can not only achieve 15%-25% procurement cost optimization but more importantly build sustainable cross-border supply chains. Amid accelerating globalization of NEVs, professional matters must be handled by professionals.

(Note: All data sourced from China Customs, S&P Global Mobility and corporate case studies, reproduction requires authorization)

Authors IntroductionWith 20 years of experience in international trade of automotive components.

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912