- 20 Years of Expertise in Import & Export Solutions

- +86 139 1787 2118

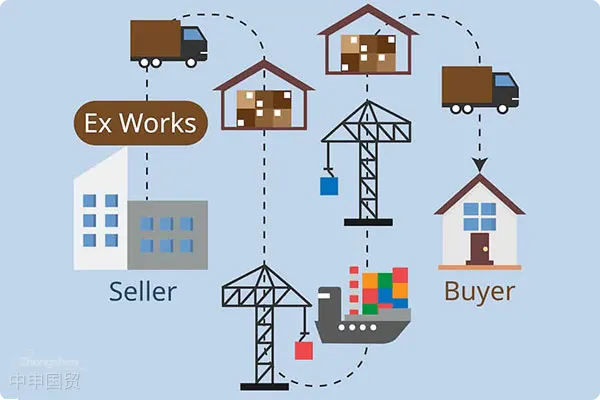

In international trade, EXW (Ex Works) is a trade term particularly favored by manufacturers. The reason is simple: the manufacturer only needs to prepare the goods at their own factory and hand them over to the freight forwarder, leaving the rest to the buyer—how hassle-free! But don't celebrate too soon. While EXW may be operationally convenient, it can land you in hot water when it comes to tax rebates and financial processing. Today, let's talk about the easily overlooked "pitfalls" behind the convenience of EXW and how to navigate them wisely.

The Convenience of EXW and the "Dilemma" of Tax Refunds

The advantages of EXW are obvious: the manufacturer simply hands over the goods to the freight forwarder and is done, without worrying about cumbersome processes like transportation and customs clearance. Many?Foreign trade?Companies prefer this method, finding it easy for themselves and convenient for the boss. But here's the problem: many manufacturers, after closing deals on EXW terms, still want to take...?Tax Refund?The benefits. In theory, under EXW, customs declaration and tax refund have nothing to do with the manufacturer. However, in reality, freight forwarders require the manufacturer's name for customs declaration, and the tax bureau also assumes that the manufacturer can handle the tax refund. As a result, manufacturers under EXW still have to get involved in the customs declaration process.

Here’s the problem. Under EXW, the manufacturer’s financial records only account for the ex-factory price of the goods—for example, $100 for the goods, and that’s what’s recorded in the books. However, tax and customs authorities require revenue to be recognized based on the FOB (Free On Board) price, which includes additional costs like port handling fees and domestic transportation, totaling, say, $110. Under EXW, these expenses are borne by the buyer, so the manufacturer doesn’t receive a single cent for them, nor can they be recorded in the accounts. As a result, the financial revenue doesn’t match the taxable revenue, leading to headaches when claiming tax refunds.

Policy Changes: New Challenges in EXW Customs Declaration

What's even more frustrating is that recent policy tightening has added new complications to EXW. In fact, since July 21, 2022, if EXW is used for customs declaration, the customs authorities require the inclusion of miscellaneous fees, such as port handling charges and domestic transportation costs. For example, if the factory price of the goods is $100 and the miscellaneous fees are $10, the declared amount at customs would be $110. However, the manufacturer actually only receives $100 in foreign exchange. When comparing the foreign exchange amount with the declared customs value, there's a $10 discrepancy, which naturally causes issues with tax rebate applications.

What's even more troublesome is that when the tax bureau reviews tax refunds, they require manufacturers to provide supporting documents for expenses such as transportation from the factory to the port, customs clearance fees, and port handling charges. However, under EXW terms, these costs are borne by the buyer—so how can the manufacturer have these documents? If they ask the customer, the customer might not provide them; if they ask the freight forwarder, the forwarder says it's none of their business. The manufacturer is caught in the middle, stuck between a rock and a hard place.In fact, the current business operations are already strictly handled in accordance with relevant regulations, and there will no longer be any "turning a blind eye" or "looking the other way."JustThe occurrence of a "single glance" situation.

Risk Warning: The "Hidden Troubles" Under EXW

Using EXW for customs declaration not only complicates tax refunds but may also expose you to other risks. For instance, if the tax authorities discover incomplete or incorrect reporting of miscellaneous fees during an audit, your tax refund could be delayed or even result in penalties. More seriously, if deemed to involve false reporting or omissions, it could even affect your company's credibility.

For example, a company used EXW for export but failed to declare port handling fees and domestic freight during customs declaration. As a result, the tax authorities identified the issue as affecting the accuracy of customs statistics, requiring not only the payment of additional fees but also potentially facing penalties. Such "hidden troubles" make many manufacturers nervous when using EXW.

Solution: FOB may be the only option.

Facing these issues with EXW, is there any good solution? Actually, it's quite simple—just use FOB terms. Under FOB, the manufacturer must deliver the goods to the port and load them onto the ship, with port charges and domestic transportation fees all covered by the manufacturer. This way, the financial records will include these costs, aligning with the tax authority's requirement for FOB-based revenue, and there will be no need to worry about supporting documents during tax refunds.

Of course, if the client insists on using EXW, you can try to stipulate in the contract that the buyer provides proof of expenses or declare the FOB price during customs clearance (but be careful to avoid conflicts between the contract and actual operations). However, the most hassle-free approach is to directly agree on FOB during negotiations—it ensures smooth tax refunds and reduces a lot of complications.Under the current circumstances, it may be advisable to consider abandoning clients who insist on EXW quotations.

Final Notes

EXW may seem hassle-free, but it can easily lead to "pitfalls" in tax refunds and financial matters. Especially after policies tightened, the difficulty and risks of declaring EXW at customs have increased. Therefore, in international trade, choosing the right trade terms is truly important. FOB might require a bit more effort, but at least it ensures smoother tax refunds and accounting processes. Hope these insights serve as a reminder—next time you negotiate a deal, stay vigilant to avoid unnecessary pitfalls!

? 2025. All Rights Reserved.